Table of Contents

What Is Decentralized Finance (Defi)?

Decentralized finance (Defi) is an economic innovation in light of secure conveyed records like those utilized by digital money. The framework removes the control banks and establishments have on cash, financial items, and economic governments.

A percentage of the critical attractions of Defi for some purchasers are:

It kills the expenses banks, and other monetary organizations charge for utilizing their administrations.

You hold your cash in a protected computerized wallet instead of keeping it in a bank.

Anybody with a web connotation can utilize it without requiring confirmation. You can move in a flash and minutes.

Algorithms select that data which could be left as trivial as a useful metric and used to invest in the business. Everyone was surprised by the profits, not by RC Metrics: they were prepared. It’s a silver lining of how quantitative investing can be used.

The firm should hire an effective head of quantamental tool kits investing strategies to lead the effort whilst also ensuring the firm can accommodate new personnel with different skills.

Decentralized Finance

Decentralized finance disposes of mediators by permitting individuals, vendors, and organizations to manage monetary exchanges through innovation. It achieves through shared economic organizations that utilize security conventions, networks, programming, and equipment progressions.

From any place you have a web suggestion, you can loan, exchange, and obtain involving programming that records and confirms economic activities in dispersed financial data sets. A dispersed information base is open across different areas; it folds and totals information from all clients and operations an agreement component to check it.

Decentralized finance utilizes this innovation to dispose of unified finance models by empowering anybody to utilize monetary administrations anyplace, paying little heed to who or where they are.

Defi applications give clients more command over their cash through private wallets and exchanging administrations that take care of people.

How Does Defi Work?

Decentralized finance utilizes the blockchain innovation that cryptographic forms of money use. A blockchain is a dispersed and gotten information base or record. Applications called dApps utilize to deal with exchanges and run the blockchain.

In the blockchain, exchanges are kept in blocks and afterwards checked by different clients. Then, assuming these verifiers settle on a business, the block is shut and encoded; one more block has to make with data about the past block inside.

The blocks are “affixed” together through the data in each continuing block, giving it the name blockchain. You can’t change the Data without influencing the accompanying blocks, so it is impossible to modify a blockchain. This idea, alongside other security conventions, gives the solid idea of a blockchain.

Defi Financial Products

How Does Decentralized Finance Respond?

The objective of Defi is to dispose of the outsiders associated with all monetary exchanges.

Is Bitcoin a Decentralized Finance?

Bitcoin is a digital currency. Defi intended to involve digital currency in its biological system, so Bitcoin isn’t Defi, however much it is a piece of it.

What Is Total Value Locked in Defi?

All-out esteem locked (TVL) is the amount of all digital currencies marked, lent, saved in a pool, or utilized for other monetary activities across Defi. It can likewise address the amount of explicit digital money used for financial exercises, like ether or bitcoin.

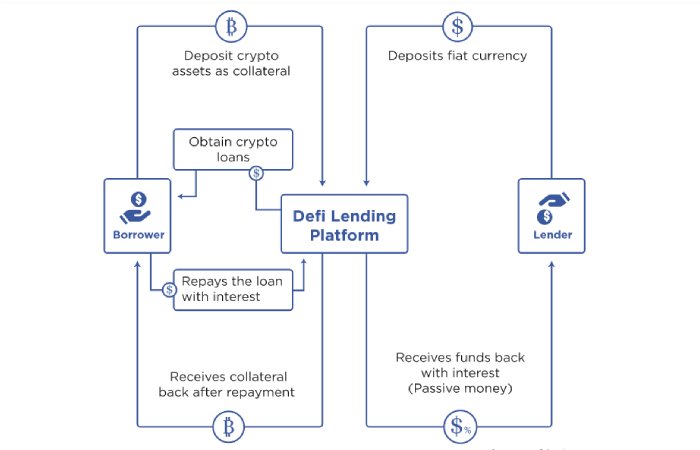

Distributed (P2P) monetary exchanges are one of the central premises behind Defi. A P2P Defi exchange is where two gatherings consent to trade cryptographic money for labour and products without an outsider.

To completely grasp this, consider how you get to edit in unified finance. First, you’d have to go to your bank or another money lender and apply for one. Then, assuming support, you’d pay interest and administration charges for utilizing that bank’s administrations.

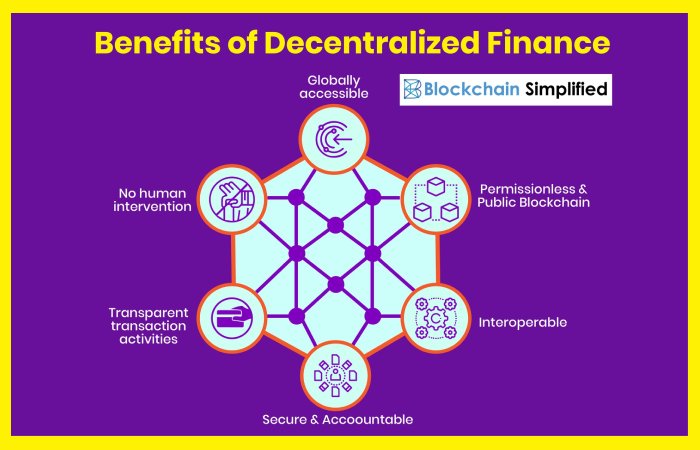

The advantages of Defi

Defi offers many convincing use cases that are past the compass of regular fiat-based monetary frameworks. Here are a few advantages of Defi:

Defi is permissionless and comprehensive. Anybody with a crypto wallet and a web association, paying little mind to where they are, can get to Defi administrations. Clients can likewise make exchanges and move their resources any place they need, without hanging tight for bank moves or paying standard bank charges. (Albeit other crypto-explicit charges, for example, gas expenses, may apply.)

Exchanges are continuous. The entire blockchain is refreshing the second an exchange is finish, and loan costs are refresh on different occasions consistently.

Exchanges are straightforward. For each business, the Ethereum blockchain, representing over 90% of Defi traffic, is communicate to and check by different organizations’ clients. This degree of exchange of information straightforwardness guarantees any client can see network movement.

Clients can hold the authority of their resources by utilizing non-custodial crypto wallets or through brilliant agreement-based escrow.

Intelligent contracts are profoundly programmable and intended to execute because of many factors naturally.

Defi information is careful design, secure and auditable using blockchain engineering.

Numerous Defi conventions are open source. Ethereum and different activities work with open-source code, which is accessible for anybody to view, review and expand. Engineers can undoubtedly interface numerous Defi applications based on open-source innovation to make new monetary items and administrations without looking for authorization.

The dangers of Defi

Defi offers intriguing monetary opportunities. However, these accompany gambles. These dangers include:

Defi innovation is youthful and can’t seem to be under thorough pressure at scale over a lengthy period.

As a result, assets might lost or seriously endangerer. The Defi stage Compound, for instance, experienced a severe error as of late, unintentionally sending a considerable number of crypto dollars.

An absence of buyer security. Firstly, Defi has flourished without any standards and guidelines. It implies that clients frequently have no protection when things turn out badly.

Secondly, No state-run repayment plans cover Defi, and there are no regulations upholding capital stores for Defi specialist organizations.

Programmers are a danger. While here, hacking is likewise a gamble in conventional money, DeFi’s drawn-out mechanical engineering, with numerous places of expected disappointment, builds the purported assault surface accessible to modern programmers.

For instance, “white cap” programmers took advantage of a brilliant agreement weakness in August 2021, taking $610 million from the Defi stage PolyNetwork. Fortunately, I returned all assets.

Furthermore, Guarantee prerequisites are high. Virtually all Defi loaning exchanges require insurance of around 100% of the worth of the advance, while possibly not more.

However, These prerequisites boundlessly confine qualifications for some sorts of Defi advances.

Personal key necessities. With Defi and digital currency, clients should get the wallets to store cryptographic money resources. It is a significant necessity for both individual confidential financial backers and institutional financial backers to utilize multi-signature wallets. Hidden keys, which are long, remarkable codes known exclusively to the wallet’s proprietors, are use. If a confidential financial backer loses their key, they lose admittance to their assets for eternity.

What is a decentralized money stage?

Defi — short for decentralized finance — is another vision of banking and monetary administrations that depends on distributed instalments through blockchain innovation. Defi permits “trust-less” banking through blockchain, evading customary economic agents like banks or representatives.

Why Defi is what’s in store?

Similarly, to conventional monetary foundations, Defi additionally permits you to stay in the guardianship of your financial resources. It an exceptionally current and decentralize approach to getting things. Defi innovation is the future since it carries answers for conventional monetary issues.

CONCLUSION

With smart contracts on a blockchain, decentralized finance offers monetary instruments without depending on middle people like businesses, trades, or banks.